It’s currently estimated that 27 million people are unemployed across member states of the European Union, not including those who are under-employed, in unsustainable employment, and economically inactive – not in work nor seeking employment.

The competition was launched for the first time in October 2012 and was the idea of Diogo Vasconcelos, a visionary whose span of work entailed bringing people together to tackle societal challenges and create a better future. Vasconcelos was the chairman of Social Innovation Exchange before he passed away in 2011. He wanted to incentivize people to come up with radical solutions to problems and this competition was created in his memory.

Three winners, chosen from over 600 ideas, were named in March 2013 from last year’s competition with a similar theme of job creation. Community Catalysts from the UK came up with an idea to create employment through micro-enterprises that would offer social care and health services to people, including the elderly and people with disability. Economy App from Germany aims to facilitate a barter economy through a platform where people would offer their services and products. MITWIN.NET from Spain proposes an intergenerational professional network allowing older workers to share a job with younger people.

Similar to last year, each of the three winners will receive €20,000 as financial support. Applicants have until December 11, 2013 to submit their entries. The competition is open to anyone – individuals, for-profits, nonprofits – legally established or a resident in the European Union member states. Ten finalists will be invited to an award ceremony in May 2014 where the winners will be announced.

]]>Social Good Lab is an initiative between Paris Incubateurs, a Paris-based incubator network of over 400 startups, and Le Comptoir de l’Innovation, an impact investment and consultancy firm.

The City of Paris and Bpifrance, the country’s public bank for assisting and financially supporting French micro to small and medium enterprises, are backing the incubator through their “Paris Innovation Amorçage” fund, which is designed to finance innovative pre-seed or seed stage projects.

Although incubators and tech firms are a familiar couple, Social Good Lab purposely focuses on technologically innovative social enterprises in hopes that the tech sector can become more inclined to benefit society with their innovations. Likewise, Nicolas Hazard, the president of Le Comptoir de l’Innovation, is counting on the possibility that Social Good Lab can influence other businesses to draw inspiration from social ventures in their ability to balance operations while creating positive impact to society.

What remains to be seen is the extent of their impact, but for now these are the eight startups to follow:

1. Arizuka

Arizuka, meaning anthill in Japanese, is a crowdfunding platform for organizations developing socially, economically, and environmentally innovative projects.

2. Cine Apps

Described as a young enterprise, Cine Apps has developed digital cinema “smart glasses” and “smartphone” services, such as personalized subtitles, last-minute bookings, alerts, and public transport information, for people with sensory impairment.

3. Eqosphere

Eqosphere is a collaborative web platform that facilitates the redistribution of end-of-life products and items that are unsold to reduce food and non-food waste.

4. microDON

microDON aims to revolutionize how donations are made by creating a service that allows people to round up the bill on their everyday purchases, so that anything from a few cents to a few euros would be donated to a specific cause.

5 and 6. Planète Langue des Signes and Egonocast

Planète Langue des Signes, professionals in sign language for audiovisual purposes, and Egonocast, a multimedia software company, have partnered to create a sign language translation service for television.

7. Power:On

Power:On developed a software capable of determining which hybrid of power supplies (solar, diesel generator, etc.) costs the least in a given situation, so that they can assemble sustainable and innovative solutions for rural communities that do not have access to electricity.

8. Social Club

Social Club aims to address the digital divide in France and around the world by creating a search engine that runs without access to the Internet, but uses interactive voice response to parse spoken queries and redirect the user to the person most suitable to respond.

]]>In no small part this was due to various fringe events at all three, looking at the role of mutuals, the role of business in the local community, and plenty of others where social enterprise was referenced as part of the solution to wider challenges, including on topics as varied as youth employment, education, and health among others.

A strong presence for social economy organisations was also ensured thanks to the Social Investment Forum, a network for providers of social investment and social finance, and the Social Economy Alliance, a consortium of 22 UK cooperatives and social enterprises, universities, think tanks, and charities.

The Liberal Democrats kicked things off in late September with their conference, which had the tag line “Fairer society, stronger economy”. The main thrust of their message was that neither of the other two main parties – Conservatives or Labour – could be trusted to deliver both, so the Liberal Democrats could be relied upon as a regulatory force.

But in spite of a tagline that seems a natural fit with the wider social economy movement, there were few policy announcements that could be considered social enterprise-friendly, and the Social Economy Alliance fringe event was poorly attended by party delegates. Much of the economy policy focus was on encouraging big business and banks to play more fairly, such as reducing the use of offshore tax havens for instance.

A week later the Labour Party resurrected the spirit of old, paraphrasing ex-Prime Minister Tony Blair by talking about “an economy and a society which is not only for the privileged few”. One of their key policy proposals was to introduce a 20-month freeze in energy prices if elected. This announcement prompted a four point gain for Labour in the opinion polls whilst simultaneously causing mild panic on the markets, with £2 billion being wiped off the value of some of the big energy companies. Labour leader Ed Miliband also announced that they would introduce a £800 million tax break for small businesses, which by default would include many social enterprises.

The Social Economy Alliance responded to the energy announcement by emphasising the existing work of cooperatives and social enterprises in the energy sector. In an open letter the Alliance asked for a “21st century debate”, arguing it “must not be about big state versus big business. But about big problems versus big opportunities”.

The response in the mainstream media to the Labour conference focused on the return of socialism, providing a benchmark against which the Conservatives would further define and distinguish themselves. A principal message of the Conservative Party conference concerned how they were “pro-business” and Labour were “anti-business”. While the conference was light on policy announcements which could impact on the social economy, Prime Minister David Cameron emphasised the party’s pro-business stance, exclaiming “profits, tax cuts and enterprise… are not dirty, elitist words”.

The fringe event at the conference brought home the scale of the challenge still facing the social economy. At the event Minister for Civil Society Nick Hurd said, ”You would think in a government obsessed with growth, someone would notice that one part of the economy was growing faster than the rest”, referring to the low profile social economy organisations still have with many government departments. While largely advocating the role social economy organisations could play in the future, he challenged social enterprises in particular to reach the scale required in order to make them attractive to government commissioners.

The conference concluded this Wednesday, with the Social Economy Alliance responding to David Cameron’s keynote speech by urging all political parties, not just the Conservatives, to better explain what sort of businesses they want to see thrive in the UK.

“Business is key to solving our economic and social problems. Society and the economy cannot exist without one another and the Prime Minister is right to promote the critical importance of genuine enterprise. What all parties must do now is explain the sort of businesses they want to see thrive in this country”.

Despite differences in their politics, what is clear is that politicians of all persuasions support the idea of social enterprise and entrepreneurship in principle, but do not yet see it as being a significant enough area to justify substantial policy interest. With just 20 months to go, it remains to be seen whether the sector as a whole is able to change that.

]]>The report, written by The International Centre for Social Franchising (ICSF) on behalf of the Big Lottery Fund, fills a gap in the sector’s knowledge by providing quantitative data on social replication and franchising, which has previously been lacking.

The lack of information available to ensure successful replication was cited by respondents as a primary reason why organisations aren’t pursuing this route. Despite the clear benefits to replication, many organisations still lack the knowledge required in order to scale their impact in this way. Fifty-five percent of respondents who had not yet replicated their work felt they did not know enough to consider social franchising in the future, and even amongst those who had already replicated, 35 percent felt they still lacked sufficient knowledge.

Organisations participating in the research warned that replication needs the right conditions to work. The majority felt that grant funding is an essential prerequisite for replication, with the report finding that most types of organisation – from charities to social enterprises – were more likely to use grants to cover the costs of replication. Seventy percent of those who had already replicated their work spoke of using grants to build organisational capacity and/or to finance the ongoing costs of franchising, such as staff salaries. As such the research suggests that there is currently not a sufficient pipeline of replication-ready organisations to feed the expanding UK social investment market, recommending that a ‘replication readiness’ fund could be required in future.

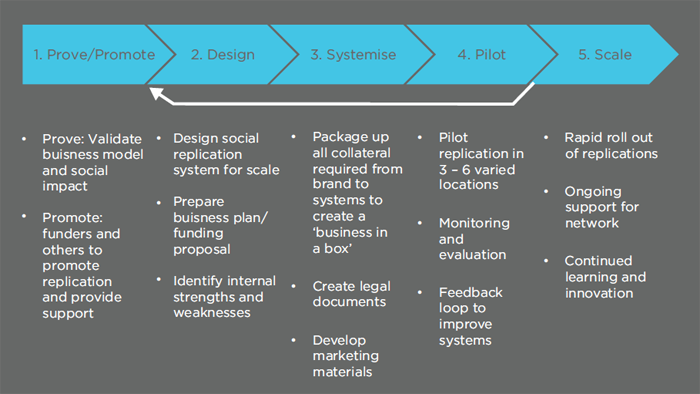

As a result of this research, ICSF have developed five steps they believe could help the chances of organisations successfully replicating their work.

Source: Realising the Potential of Social Replication, The International Centre for Social Franchising.

Source: Realising the Potential of Social Replication, The International Centre for Social Franchising.

Dan Berelowitz, Chief Executive for the ICSF, said, “This research has been critical, not only in confirming ideas we have been pursuing to help others replicate, but also for creating new strategies to ensure every proven organisation that has the potential and desire for replication is able to.”

]]>Despite being a third of the size of the previous year, the fifth International Social Innovation Research Conference (ISIRC) still pulled together almost 50 papers, all offering international perspectives on topics such as social investment, social impact measurement, and organisational hybridity.

Held within the Said Business School, this year’s conference was open to the same criticisms the Skoll World Forum faces, in the respect that it discusses real world problems such as poverty in the contradictory setting of a glamorous and historical university. But despite sharing the same location, the conference carried nowhere near the same price tag, enabling researchers from academia, policy, and practice to attend and present their latest work. All set out to provide an overview of social innovation in their respective countries, based upon empirical evidence rather than political rhetoric.

The conference started with a paper looking at the barriers to, and potential of, impact investing in Germany. Based upon a literature review and their own empirical research, Gunnar Glanzel and Thomas Scheuerle of the University of Heidelberg highlighted how impact investing remains an emerging and under-resourced area in Europe’s largest economy. Yet, as it continues to develop, there are increasing tensions between the language, culture, and personality traits of investors and investees, which are jeopardising the likelihood of social innovators accessing the finance they require.

Their analysis also suggests that the increased emphasis being placed upon impact measurement in Germany and elsewhere could actually undermine impact investment opportunities in the long-term, as it takes away the scarce resources social innovators have for creating social impact in the short-term.

This paper, and many others that followed, served to challenge the political rhetoric coming out of many countries with regards to how social innovation should be supported and financed. In particular, several tenets of neoliberalism came under attack throughout the conference with regards to their role in social innovation – such as the role of competition, deregulation, and the role of the individual.

For instance, a team of Finnish researchers from Lappeenranta University of Technology examined Global Entrepreneurship Monitor data from across the world to show that the more egalitarian a country is, the greater levels it has of entrepreneurship. Greater individualism was more likely to produce negative effects.

With cuts to public spending feted as an opportunity for social innovators across Western economies, research from the University of Northampton challenged the reality of public service spin-outs in the UK, and in particular the rationale that spin-outs lead to public services more responsive to their user’s needs.

The research found the reason most services spun-out was because existing staff wanted to retain control of their service, and that private sector consultancies were heavily involved in shaping what these services looked like after they had been spun-out. When looking at the main sources of income for these spin-outs, for most, the majority of their income is made from the public agency they span out from.

The growing interest amongst policymakers and financiers in innovative solutions to social problems continues to be welcomed across the world, though the general consensus at ISIRC is that research can hold such power to account, ensuring the developing policy framework in this area reflects the reality experienced and lived by practitioners worldwide.

]]>McGrath is the former Chairman of Prudential (2009-2012) and Man Group (2000-2007) and will succeed Cohen, who has been slated to serve as Chair until BSC was fully operational.

Following a failed takeover bid in 2010 that left Prudential with a £377 million bill in costs and fees, shareholders voted against McGrath’s re-appointment, although he had no intention of stepping down.

But he continued to focus on philanthropic work, serving on the advisory board of Bridges Ventures, where Cohen is Chair, and receiving a Beacon Award for Philanthropy.

“I have been closely involved for ten years with social impact investment,” said McGrath. “I am excited to have this opportunity to contribute to Big Society Capital’s leadership in driving entrepreneurship and innovation in tackling social issues.”

Cohen said, “[McGrath] has extensive philanthropic and investment experience and is a firm believer in impact investment. After handing over the Chairmanship on 1st January 2014, I much look forward to working with him and the rest of the Board. Big Society Capital has developed into a powerful force driving social improvement in the UK and I have been privileged to be its founding Chair”.

]]>The company explains:

Initially, we decided to set up our formal organizational structure as an NGO (non-governmental organization). We soon realized however that, despite share values of creating social impact, the NGO structure was not a perfect model to choose. Around the same time, we had been in talks with operators, who were willing to support us on both our mission and the sales and there were an increasing amount of people asking us when the phone would hit the market, so they could buy it. “Wow!”, we thought, but also “mmm, what now”.

Realizing that it would be easier to market the product and generate revenue to fund the long-term mission, becoming “a ‘real’ company made more sense”. So with the help of the Waag Society and seed investment from an investor, Fairphone launched three years ago.

After a crowdfunding campaign from May to June to start mass production with 5,000 phones, the Dutch company managed to double sales with almost 10,000 phones sold within that period. So they decided to produce 20,000 phones this year (then raised to 25,000), with over 14,000 already sold.

The company just announced that the phones will be delivered to customers in December.

Prized as an ethical phone, Fairphone is cautious to produce a phone with conflict-free materials and to be transparent with their work. For instance, customers were briefed through blog posts regarding concerns about the phone being produced by a manufacturer in China, A’Hong, who has factories in Shenzhen and Chongqing.

To date, the phones are only sold in Europe and through their website, but plans are to expand into retail in 2014.

Photo courtesy of Fairphone.

]]>“Magazine years are like dog years. Mental health is a really interesting area any way. It’s an area where there isn’t really that many social enterprises, at least many successful social enterprises.”

The magazine, which seeks to help people understand mental health difficulty from the perspective of those who experience it, has survived despite sustained cuts to public sector spending. “We started selling in bulk to major organisations, such as the NHS, and that was going OK until 2010. It was amazing the effect of the change in government. It was like a portcullis coming down. And quite quickly people began cancelling their subscriptions.”

Added to this, the magazine has bucked another trend by being a successful publication on mental health – only earlier this year one of the UK’s largest mental health charities Mind, cancelled its magazine ‘Open Mind’ after 15 years in circulation.

So how have they done it? “We’ve kept it going because we really want to keep it going. We’ve done that by grafting and hustling and getting by. I think that’s the reality of small business,” argues Brown.

It’s a reality Brown believes is all too often lost in the hype around social enterprise. He is a strong advocate of the old adage that ‘small is beautiful’, suggesting that the magazine’s success is due in part to the company’s flexibility and agility. “We’ve been more successful the more we’ve slimmed down, bizarrely. Making it to the end of the month requires the agility of not having a large staff team. There’s no great big contracts, huge endowments, or massive reserves. That’s how we’ve survived, by being small and dirty.”

The magazine gives those with experience of mental health difficulties a chance to help and educate others by writing for the magazine, receiving modest remuneration in return too. Brown feels this is what gives the magazine its distinctive edge over others that have tried and failed to break this area, having also experienced these issues himself.

“No one actually believed that you could do a good magazine written by people with mental health difficulties. And funders and investors had sort of had their fingers burnt in the past, by putting up the money for a magazine or publication, which maybe was not so great, and it disappearing once the funding ended.”

Several of his writers have since gone on to write for other publications, which Brown suggests shows how mental health can be part of a normal life, and that the two things need not be exclusive of each other. “[We’ve shown] that useful mundane advice is better than inspiring stories of people riding up Everest on a unicycle.”

Brown now looks forward to the next five years and beyond, intent on continuing to improve the content of the magazine and expanding its market.

What tricks can an old dog teach the rest of the sector? Brown had the following advice for other potential and nascent social entrepreneurs about what it takes to sustain a social enterprise. “A lot of good social enterprise ideas won’t get off the ground unless they go through the dirty, grimey period. It’s not all going to be exciting award ceremonies, with flash cars and flash suits. It’s going to be unpleasant sleepless nights and hard graft. That’s how we’ve kept it going. We’ve kept it going against financial sense but through a strong moral sense.”

]]>Namely, they are to ensure simple investment products are eligible (including unsecured loans); increase the size of eligible investment into social sector organizations; extend the range of permitted indirect investment schemes (including venture capital trust-like schemes); and permit investment into social impact bonds (SIBs).

BSC agrees that a tax relief is important because social enterprises and charities play an integral part in the British economy and society, but lack the capital they need to do more. Individual investors are a key part to the social investment market’s next phase of growth, and a tax relief can boost investor appetite.

However, they have some remaining concerns.

For example, they disagree with the need to link between returns to the social investor and the financial performance of the social sector organization, saying that it would only provide relief for quasi-equity investment products. BSC proposes including simple investment products that don’t require this link.

They also propose investigating whether it is possible to increase the size of investment into social sector organizations beyond the European Commission de minimis “state aid” regulation of €200,000 (approximately £150,000). This is because research shows the average investment size in the social investment market is £264,000.

Then there’s the rationale to include indirect investment schemes. By restricting investment structures to only “nominee” schemes, BSC fears it misses a large group of potential investors.

Finally they hope that social impact bonds will be included in the tax relief. Yet, while this may attract investors and open up capital from new sources, the first retail SIB had previously shown that there are various problems standing in the way of its success.

The government had opened an invitation to comments on the introduction of the social investment tax relief, which closes on September 6.

]]>The Future for Children Bond

It’s difficult to establish a common ground for SIBs given that they are a work-in-progress and that SIB contracts have tailored features. In New York City’s bond, Bloomberg Philanthropies contributed a $7.2 million grant to “insure” the $9.6 million loan made to fund an intervention program to lower recidivism. With the same goal to reduce recidivism, UK’s Peterborough SIB, which raised around $8 million from 17 investors to fund a program, does not have this investment guarantee.

Still, both SIBs were formed with the intention of raising private capital to address social problems. They would both repay investors from public sector savings if readmissions decrease by a predetermined percentage.

Allia’s Future for Children Bond, which was created to improve the outcomes of children aged 11 to 16 at risk of going into care, has two distinctive features. Aside from being open to retail investors, it invests in two programs rather than one and it doesn’t need to rely on public sector savings to repay investors.

Of all the funds raised, 78 percent is used towards a low-risk, fixed rate loan to Places for People for affordable housing. For instance, if £1,000 were invested into the Future for Children Bond, £780 would be loaned to Places for People. Repayment of the loan plus compound interest by Places for People would equal £1,000, as this SIB offers a minimum 100 percent return to investors.

Another 20 percent is used towards the Essex County Council’s SIB (ECC SIB) where a return is not guaranteed. The ECC SIB funds a Multisystemic Therapy program by Action for Children for 380 children and their families, with a target of diverting 100 children from entering care.

Although the ECC SIB had already raised its required £3.1 million from institutional investors, one of the investors, Esmée Fairbairn Foundation, offered to scale back their commitment by £200,000 to accommodate the Future for Children Bond. This would allow a no-risk opportunity to test the appetite of retail investors as the ECC SIB would go ahead regardless of whether the Future for Children Bond raises its £1 million target. If the program is successful, the cost savings for Essex County Council would be used to provide a return to investors.

The remaining 2 percent goes to Allia for management fees. With respect to other features, the Future for Children Bond has a term of 8 years and requires a minimum investment of £15,000 – above the ISA allowance of £11,520 – to encourage investors to conduct due diligence on this unfamiliar product. As another precaution, investors must apply for the bond through a financial advisor.

The bond was launched on February 4 with a closing date of March 15. There was substantial interest from investors, but the uptake was slow. The offer period was then extended for another four weeks ending April 12. Despite the extension, subscriptions remained too low for Allia to cost effectively manage the bond, so they decided not to issue it in the end.

Why did the bond fail?

NPC, a London-based consultancy firm and think tank for the charity sector, was asked by Allia to perform an independent evaluation of the Future for Children Bond. They released a report last month on the lessons learned from the bond. It examined potential factors that led to the bond’s failure and their implications for the future development of these bonds as well as social investment products in general.

Marketing

Timing was an issue for this bond. Advisors felt the offer period was too short, which could have been avoided had Allia decided not to invest at the same time as institutional investors for the ECC SIB. If they invested at a later date it would have resulted in additional legal costs and made interim valuation difficult.

Because of confidentiality clauses with the Essex County Council, Allia experienced some delays in producing the offer document and had to cancel some marketing initiatives planned before the launch. This could produce some issues in cultivating investor knowledge, given the social investment market’s embryonic state and the product’s complexity.

In fact, The Sunday Times previously reported on a range of potential returns for the Future for Children Bond, not realizing that the returns should only be attributed to the 20 percent portion invested in the ECC SIB. The product is no less confusing for the retail investor. In one application that Allia received, the investor wanted to put £40,000 into the bond, but did not understand that the product would not generate regular income, even after he was required to apply through a financial advisor. Upon this discovery the investor withdrew his application. The challenge for Allia and other bond managers is to ensure they do not draw claims of mis-selling the bonds.

A lack of established distribution channels in the social investment market for a wider pool of retail investors made it difficult to market the bond. The reality is that there aren’t a lot of financial advisors in the mainstream firms interested in social investment products, especially since product offerings are limited. Allia’s efforts may have also been hampered due to its low recognition and limited direct relationships with advisors.

Advisors

The bond offer period coincided with a busy time for financial advisors – the end of the tax year. Coupled with an unfamiliar product requiring time-consuming advisory services, the bond may have been destined for failure after all. Adding to the strain is the Retail Distribution Review which, effective December 31, 2012, requires advisors to provide their clients with a charging structure before giving any advice, described in the report by one advisor as “the biggest change the adviser market had seen in 20 years.”

The cost of advising on social investment is therefore high. Advisors are required to get training, educate clients, and conduct additional due diligence, among other things. A couple of advisors told NPC that they estimate full costs of advising on a social investment product to be £1,000. Yet their costs can’t be recovered from such a small number of clients.

In light of this, NPC proposes “that advisers should be able to rely on independent due diligence conducted by experts in social investment with the approval of the Financial Conduct Authority (FCA).” For greater autonomy, NPC suggests the “FCA should work with social investment product providers to develop appropriate investor self-assessment so that such investors can independently check, and affirm to the product provider, that they understand the nature of the offer and consider it suitable for them.”

Bond features

Advisors felt the bond was too complex. Although one advisor believed the bond offered “dual social impact” – affordable housing and support for children, another thought the investment in Places for People to be an “unnecessary complication”. Overall they understood that the housing loan provided a low-risk element.

Some advisors thought that having protection measures such as the minimum £15,000 investment requirement was too much for most retail clients. Because Allia had to protect itself from mis-selling and potential investees from mis-buying, advisors carried the burden of ensuring clients made an informed investment. Some felt unable to advise interested investors without taking on a full assessment of the client’s financial suitability.

Other issues with the bond include a term of 8 years to be too long, the impact of inflation, and a lack of transparency surrounding the returns of the bond, such as the source of the outcomes data, as a result of confidentiality causes in the ECC SIB contract. Overall these added to the perceived risk of the bond.

Let’s do without SIBs

The research by NPC suggests that offering the Future for Children Bond to retail investors was an idea ahead of its time.

Early adopters would have had to undertake high set-up costs due to the small and nascent social investment market. Plus, the tailored nature of SIBs pushes up the cost to carry out contracts. Think tank Social Market Foundation predicts “mainstream investment into prospective SIBs is very unlikely” and that in the foreseeable future SIBs will likely “remain reliant on philanthropists and social investors”.

Furthermore, demand from retail investors have much to do with their knowledge of the product but also their appetite in regards to risk and rewards. SIB contracts are generally longer-term and don’t carry a fixed rate of return unlike conventional bonds. Upon realizing this, one investor opted to withdraw his application in the Future for Children Bond.

Investors also risk their principal investment if programs are ineffective. In reality, this is a major concern for investors. The Future for Children Bond, for instance, tried to lower risk by funding the Places for People initiative. New York’s bond, as another example, brought on a philanthropic foundation to cushion the investment, even when the investment was made by billion-dollar bank Goldman Sachs.

While policy for the UK and US social finance market focus greatly on SIBs, NPC argues against developing a market focused on SIBs and instead, for developing simpler social investment products to appeal to a wider range of investors and their advisors for sake of unlocking additional sources of capital.

]]>